Best practices mobile

Mobile Payments

Mobile payments are payments made from a mobile device, such as a phone, tablet or watch.

To provide your customers the best payment experience possible on a mobile device, you need to know what is possible and how to achieve the best results.

We distinguish between the mobile interface and the mobile payment products. Each feature their own subcategories that require different approaches:

1. Mobile interface

The mobile interface is the website (mobile web) you access from your phone or a mobile.

Back to overview

a. Mobile web (browser)

The mobile web is a browser-based version of a checkout page , which your customers can easily use with a mobile device. We offer the following tools to create such a site:

Back to overview

|

Regardless which device your customers use, our out-of-the box Hosted Checkout Page adapts automatically to the screen size. Our aim is to offer the best user interface which will give an optimal experience and help you increase your conversion. We have designed the pages with a "mobile first" approach, so you can be assured that your customers can pay easily with their mobile devices. As we host the page, we also capture the payment data for you so you have low Payment Card Industry (PCI) compliance requirements. Adapt our Hosted Checkout Page to the look and feel of your shop as described here. Learn everything about Hosted Checkout Page layout design in our dedicated chapter. |

|

|

Our JavaScript SDK allows you to design your payment page yourself, while we capture your customers’ sensitive data. You have full control of the extend and the optimisation degree. Yet, your Payment Card Industry (PCI) compliance is still reduced. Contact us to try it out now. |

|

|

In case you want to create the design for your mobile optimized payment page yourself and handle the encryption yourself, we offer you our REST API:

For both APIs we offer a detailed API Reference that lists all the functionalities and how to use them. You can always take a look at our mobile best practices for guidance how to optimize your mobile first payment page. |

- Hosted Checkout Page works with all payment methods.

- JavaScript SDK and REST API work with Visa, MasterCard and American Express.

b. Mobile app

A mobile app can be a native app or a browser-based version of our Hosted Checkout Page.

Back to overview

| Browser-based |

If you want to add browser based payments to your app, use the Hosted Checkout Page. Currently, our iOS and Android SDKs allow your customers to pay via Visa, MasterCard and American Express. Contact us to give it try. |

|

You can build a mobile app in a native way and have the payment options coded within the app. |

2. Mobile payment products

The mobile payment products allow customers to pay using distinct features or functionalities offered by their device. To make a payment, your customers need this specific device.

Back to overview

| Direct Operator Billing (DOB)/SMS |

Direct Operator Billing/SMS products exist since a very long time already. They allow customers to pay fees i.e. for public transport/parking space via their mobile phone invoice or have the amount deducted from their prepaid card. |

|

Mobile specific products have been developed over time. Banking apps allow customers to transfer money easily. |

|

| Wallets |

There are many mobile wallets developed over time, such as Apple Pay or Google Pay. They makes it easy for customers to store their payment details, as well as their shipping and billing address for a smooth, seamless payment experience. |

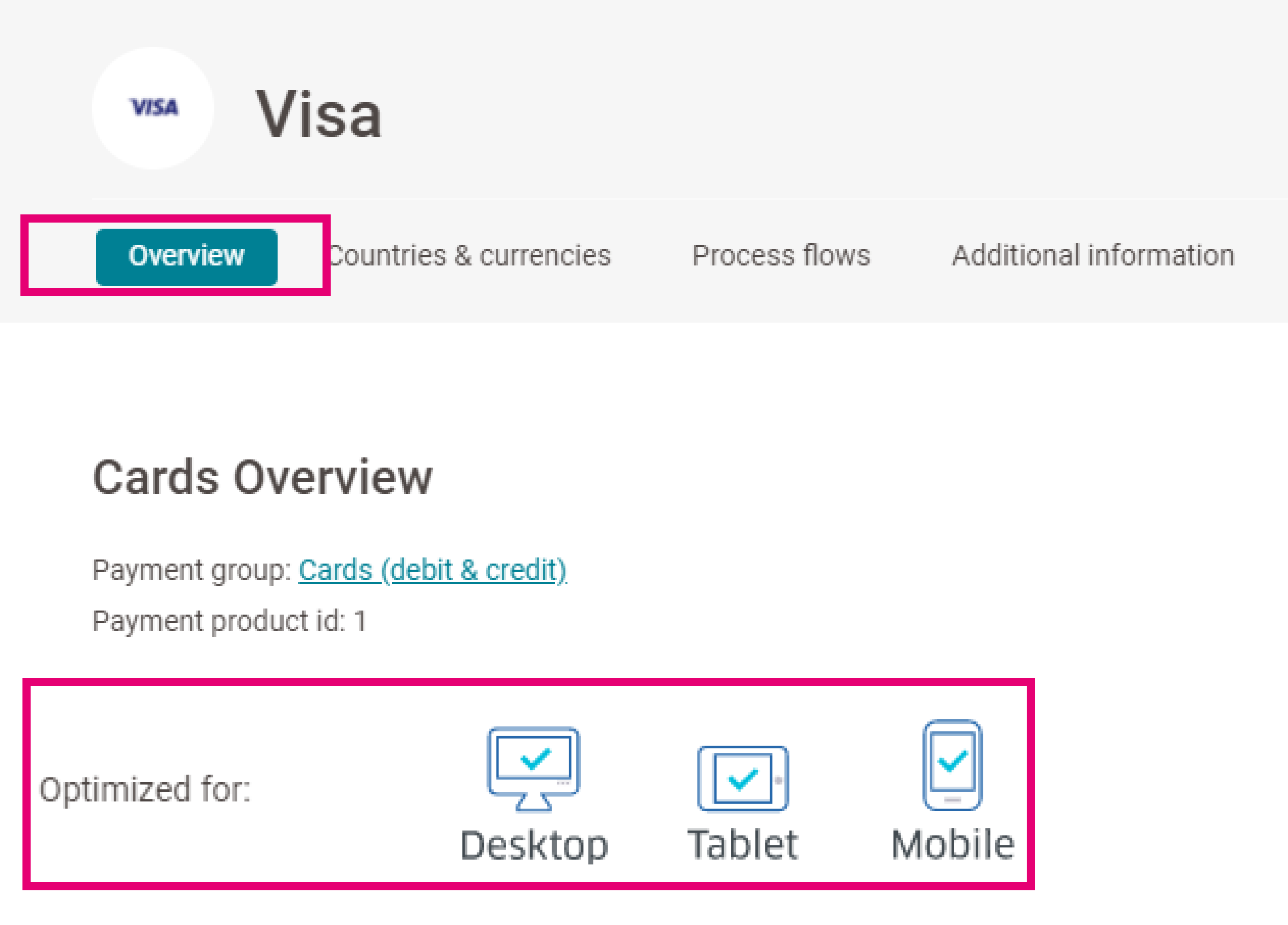

Best Practices

We have optimised all payment methods we offer for mobile devices. In some cases, regulations forbid us to alter the default form (i.e. Paypal) which are mostly optimised for mobile. Check out the "Optimised for" section in the "Overview" chapter for any of our payment methods to learn for which devices they are optimised for.

To give you a head start on mobile commerce and how to best offer this to your customers, we have collected a list of best practices:

- Ensure to optimise your website for mobile devices, while keeping the same functionality offered on the desktop version of your website. For example: if the shopping cart on your desktop is on the top right hand, put it there as well on your mobile device. Nevertheless: always start designing with the full mobile screen in mind first. Do not degrade your desktop version, but rather upgrade your mobile version. Think twice by filling the full screen of the mobile device with one big banner. Give your customers the possibility to navigate through your site, without having to scroll too much.

- The size of your buttons do matter. Try to enter data yourself. How often do you press on the right place and how often do you realise you have to zoom in so you can press the right button?

- Think about loading times. Loading a page on a laptop or desktop can be done, while watching another site. On mobile, you will keep watching your screen until the page appears. The longer it takes to load, the more likely it is your customers will leave your page. So ensure it loads within seconds, even if you are on 3G or a slow Wi-Fi connection during your holiday.

- Offer them the payment products they are familiar with, but also offer payment products that are optimised for mobile devices, which helps with your conversion rate. Look up the “Overview” tab for the respective payment method to check whether it is optimised for mobile . It is key to balance between the most favourite payment products in a country and its mobile optimisation. Some products which work fine on a desktop, might not be preferred on a mobile device, as the data entry for a customer should be minimal if they have to type with one finger only.

- Make the payment itself as easy as possible for your customers. Reduce the number of fields your customers have to fill in. On a desktop it is easy to enter your address and 16 digits of your credit card; on a mobile device you will get most likely autocorrected and have to verify twice whether you entered the correct card number.

- Offer a guest checkout, so your customers do not have to create an account. If they enjoyed shopping on your website, chances are they will return and decide to spend the additional time to create their own account after all.

- Use tokenisation to further reduce the necessary payment steps. Check out our dedicated guide to learn how it works.

- Win your customers’ trust to safely enter their credit card data on the payment page. Point out to your customers all the security measures ("Secure link", SSL certificates etc.) we have implemented.

The mobile version is not ‘just’ a smaller screen than a desktop. It is completely different:

- Your customers will probably not be sitting straight up, watching their desktop or laptop. They might be sitting in the bus, on the couch or lying in bed.

- They most likely will use one finger to navigate and enter data.

- Your banners should be simple and easily readable on a mobile screen.

- What works on desktop, will most likely not work on a mobile device.